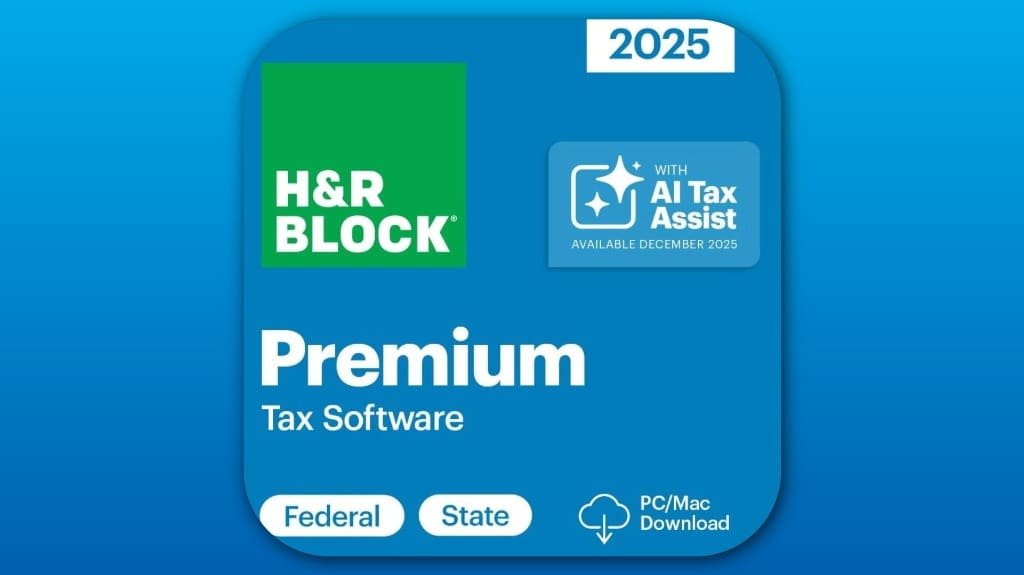

H&R Block Tax Software Premium 2025 simplifies your tax preparation with its user-friendly interface and real-time AI assistance. You can easily import documents like W-2s and 1099s, ensuring accurate reporting across all income sources. If you’re self-employed, the advanced Schedule C support maximizes your deductions. The software provides step-by-step guidance, reducing stress and enhancing confidence in your filings. Want to learn how it can further benefit your tax situation? Keep exploring.

Some Key Points

- H&R Block Tax Software Premium 2025 features a user-friendly interface for easy navigation, appealing to users of all skill levels.

- The AI Tax Assist provides real-time expert answers, enhancing confidence in tax preparation.

- Users benefit from comprehensive support for self-employment, maximizing deductions and ensuring accurate reporting.

- Effortless import of financial documents and prior tax returns streamlines the reporting process, saving time and improving accuracy.

- Overall, the software delivers a thorough environment for effective tax management, justifying its investment for users.

Key Features of H&R Block Tax Software Premium 2025

When you choose H&R Block Tax Software Premium 2025, you're leveraging a suite of features designed to streamline your tax preparation experience. The user-friendly interface makes navigation intuitive, allowing you to focus on what matters—your taxes. With AI Tax Assist, you gain real-time assistance, providing expert answers precisely when you need them. This feature enhances your understanding of complex tax topics, fostering a sense of confidence. You’ll appreciate the step-by-step guidance that guarantees you don’t miss any important deductions or credits. Overall, the software's thoughtful design and real-time support create a thorough environment for effective tax management.

Importing and Reporting Made Easy

Importing your financial documents and reporting your income has never been simpler with H&R Block Tax Software Premium 2025. You can effortlessly import forms like W-2s and 1099s, making data entry a breeze. The software allows you to pull in last year’s tax return from TurboTax or Quicken, ensuring continuity in your reporting. As you navigate through the income reporting process, the software provides clear guidance, helping you accurately report various income sources, including investments and unemployment. This streamlined approach not only saves you time but also enhances accuracy, fostering a sense of confidence in your tax preparation experience.

Guidance for Self-Employment and Rental Income

Steering through the intricacies of self-employment and rental income can be intimidating, but H&R Block Tax Software Premium 2025 simplifies the process with thorough guidance tailored to your needs. You’ll find advanced Schedule C support that helps you maximize self-employment deductions, ensuring you don’t miss any eligible expenses. For rental properties, the software offers insightful rental income strategies, guiding you through expense management and income reporting on Schedule E. This all-encompassing approach not only streamlines your tax preparation but also gives you confidence in maximizing your returns, making your financial journey feel more secure and connected.

Some Final Thoughts

To summarize, H&R Block Tax Software Premium 2025 stands out as an all-encompassing solution for your tax needs. Its user-friendly design, combined with features like AI Tax Assist and seamless form importing, guarantees a streamlined filing experience. Whether you're self-employed or managing rental properties, the software provides essential guidance to maximize your deductions. By choosing this tool, you’re not just simplifying tax season; you’re also enhancing your potential financial outcome with expert support at your fingertips.

Some Questions Answered

Is H&R Block Tax Software Premium 2025 Compatible With Mac and Windows?

Yes, H&R Block Tax Software Premium 2025 is compatible with both Mac and Windows. Its user interface is designed for ease of navigation, making it accessible for all users regardless of their operating system. Before purchasing, check the system requirements to guarantee your device meets the necessary specifications. This compatibility allows you to choose the platform you’re comfortable with while efficiently managing your tax preparation process.

Can I Access My Tax Return From Previous Years?

Yes, you can access your tax return from previous years if you've saved them in your tax software or on your computer. Retrieval of past returns is typically straightforward, as most tax programs maintain a history of your filings. Just navigate to the appropriate section in the software or locate the saved files. This accessibility guarantees you can review your financial history and make informed decisions for future filings.

What Is the Cost of Additional State Program Downloads?

The cost of additional state program downloads is typically around $39.95 each, which means you’ll need to factor in these additional fees when preparing your taxes. Be sure to review your state requirements, as some states may have specific forms or regulations that need to be addressed. Staying informed about these costs can help you budget effectively and guarantee you complete your tax submission accurately without unexpected expenses.

Are There Any Live Support Options Available With the Software?

Yes, you'll find live support options available with the software. You can access live chat for immediate assistance, connecting you to knowledgeable customer support representatives who can help with your tax preparation questions. This feature enhances your experience, ensuring you receive real-time guidance and answers, which can be essential during tax season. With dedicated support, you're not steering through the complexities of tax filing alone, fostering a sense of community and support.

How Often Is the Software Updated for Tax Law Changes?

The software's updated frequently to guarantee you stay compliant with the latest tax updates. This commitment enhances the reliability of the software, giving you confidence that your tax filings reflect current laws. You can expect regular updates, especially during tax season, so you won’t miss any changes that could affect your deductions or credits. Staying informed helps you maximize your refund and minimize potential issues with the IRS, making your experience smoother.

![H&R Block Tax Software Premium 2025 Win/Mac [PC/Mac Online Code]](https://m.media-amazon.com/images/I/51dMIAMHkkL._AC_SL500_QL70_ML2_.jpg)